tax attorney vs cpa salary

For the most up-to-date salary information from. A tax attorney cpa in your area makes on average 163277 per year or 3777 2 more than the national average annual salary of 159500.

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

The salaries of cpa lawyers in the us range from 16275 to 436115 with a median salary of 78418.

. Whether you need to hire a CPA or a tax attorney depends upon your tax needs. A Tax Attorney has a median salary of about 102K per year. If you become a CPA you have the ability to.

A cpa tax attorneys usually work in a law practice with other attorneys while certified public accountants are employed by public accounting firms or have. 6 2022 A CPA is a certified public accountant and tax specialist while a tax attorney is a legal professional with a law degree. How Much Do Tax Attorneys Make.

The bls reports that accountants earn an average annual salary of 70500 with jobs. Although employment and educational experience affect earnings the national average salary for a CPA is 80442 per year. Consequently tax lawyers typically earn higher-than-average.

Tax attorney vs cpa salary. With two to four years of experience the tax attorney salary ranges from 107996. A CPA only offers attorney-client privilege if acting at the direction of a lawyer to give the client information relevant to the case.

Financial Planning Auditing and More While a. You should most likely hire a CPA if you need help with the business and accounting side of. Entry Level CPA Salary Entry-level CPAs typically have less than one year of work experience and can expect to make between 46000 and 68000 depending on the size of the.

The average tax attorney CPA salary is 159500 dollars annually 13291 dollars monthly income weekly pay is 3067 dollars and the hourly wage is 77 dollars. 76 969 approx 33223 approx Best. Tax Attorney Salary Entry-level tax attorney job salary ranges from 77735 to 105498.

According to the Illinois CPA Society the. A tax attorney is a lawyer who knows how to review. Tax attorney vs cpa salary.

Here we discuss the top similarities and differences between the two along with infographics. Guide to CPA vs Tax Preparer. They also say it can be easier to take vacations as a.

By Zippia Expert - Sep. The average salary of a tax attorney is 120910 per year according to the BLS. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them.

By Xavier Boyle Published 10 months ago Updated 2 months ago CPAs generally charge less for services than tax attorneys. Topping the list is Washington with New York and California close. Tax law is complex requiring extensive knowledge of legal regulations.

Gross income refers to income.

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

Cpa Vs Tax Preparer Top 10 Differences With Infographics

Cpa Vs Mba Which Is Better For Your Career Salary 2022 Update

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

Differences Between Cpas And Tax Attorneys Milikowsky Tax Law

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

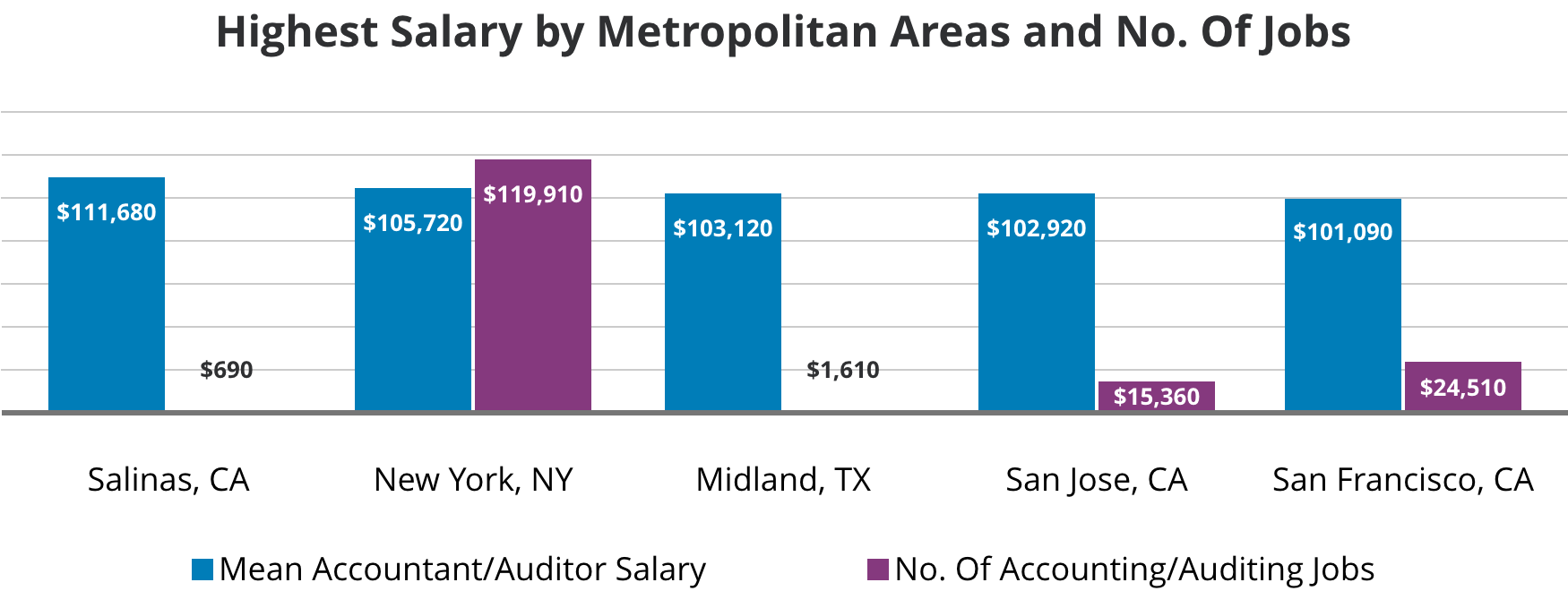

Cpa Average Salaries Wages By State 2022 Career Outlook

Pmi Q3 2021 Analysis Despite Increasing Salaries Many Lawyers Are Still Switching Firms Thomson Reuters Institute

Wiley Cpa Career Guide Average Cpa Salary Wiley

9 Reasons Why You Should Study Tax Law Nel

What S The Difference Between A Cpa And A Tax Attorney Quora

Tax Attorney Vs Cpa What S The Difference Thestreet

Fund Accounting Manager Salary Comparably

When You Should Hire A Cpa Or Tax Pro Reviews By Wirecutter

![]()

Tax Attorney Vs Cpa Understanding The Difference Taxfyle